Innovating for a new future

A series of focused investment solutions

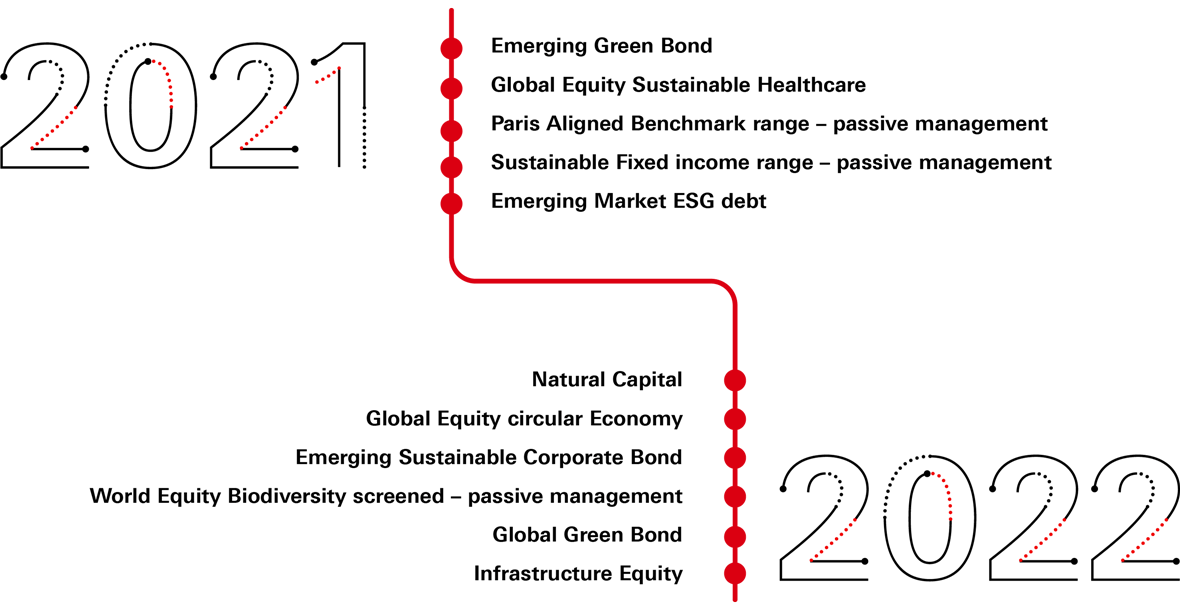

In line with the objectives of investors, we strive to contribute to positive change through a series of targeted and innovative solutions – from decarbonisation to real economic impact, and reduced climate-risk exposure. We strive to align climate considerations with investment objectives across all asset classes.

Sustainable investment solutions

This is in line with how we allocate capital and engage with investee companies in order to achieve our clients investment objectives. It also echoes our focus on bringing greater discipline to our approach in incorporating valuation and materiality frameworks, with the goal of improving risk-adjusted returns while integrating sustainability into relevant investment decisions.

This process requires dedicated sustainability and responsible-investment teams working in tandem and with the wider investments platform. So far, we can count 25 individuals who – together with 120-plus investment professionals, operating as virtual sector teams across different asset classes and geographies – support our investments platform. Together, they develop forward-looking sustainable-investment themes and bring in-depth insights on each of the sectors they cover.

Such collective efforts herald another move forward in helping to finance our own sustainable transition, while also giving investors greater access to valuable investment opportunities, including new asset classes such as natural capital.

Ultimately, our innovations in sustainable investing have a shared and definitive purpose: to support efforts to capitalise on a multi-decade investment opportunity in which new technologies, business models and investment products facilitate both long-term wealth creation and sustainable outcomes.

The information presented may refer to HSBC Asset Management's global AUMs/figures and global policies. Even though local entities of HSBC Asset Management may be involved in the implementation and application of global policies, the numbers presented and the commitments listed are not necessarily a direct reflection of those of the local HSBC Asset Management entity.

Today, we and many of our customers contribute to greenhouse gas emissions. We have a strategy to reduce our own emissions and to help our customers reduce theirs.